At first glance, Medigap insurance plans seem like a great way to ensure that you’re financially protected from medical charges. After all, they offer valuable benefits like covering any deductibles or other out-of-pocket expenses incurred from Medicare Parts A and B. But while the upside of Medigap plans is often emphasized, it’s essential to understand that there are some hidden downsides before signing up for one.

In this article, we’ll explore those potential risks and how to mitigate them so that you can make an informed decision about whether investing in a Medigap plan is worth it for your circumstances.

What are Medigap plans, and what do they cover?

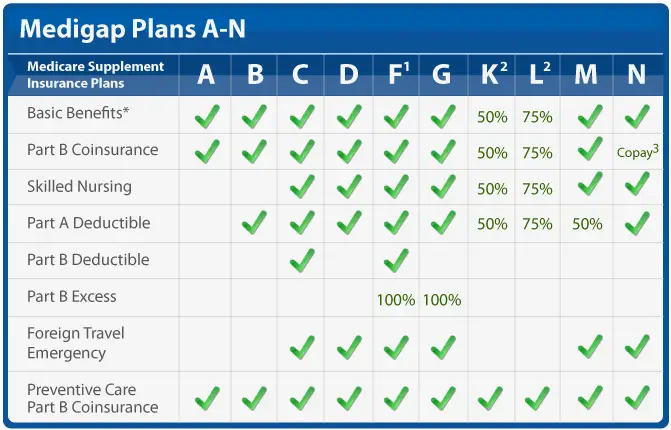

If you’re 65 or older and enrolled in Medicare Part A and B, a Medigap plan may offer the level of coverage you need. Medigap plans are standardized plans endorsed by Medicare that supplement their existing coverage. They provide additional coverage for out-of-pocket expenses, making copayments, coinsurance, and deductibles more affordable.

It’s important to note that purchasing a Medigap plan won’t cover prescription drug costs; this must be done with a separate stand-alone prescription drug plan. Even still, if you’re looking to bolster your existing Medicare coverage with additional funds, look no further than a Medigap plan – it can help reduce potential healthcare costs immensely.

How do Medigap plans work with Medicare Part A and Part B coverage?

Medigap plans supplement the coverage provided by Medicare Part A and Part B, helping to fill in the financial gaps that can often arise through healthcare expenses. These plans typically cover deductibles, copayments, and coinsurance not paid for under Medicare Parts A and B, allowing seniors to feel more secure when managing their healthcare costs.

When combined with a Medicare Advantage plan, Medigap coverage can help individuals feel at peace knowing that their out-of-pocket costs for medical care will be reduced – something of great importance as we age. Regardless of individual needs, a Medigap plan is likely available to provide support and peace of mind.

Are there any drawbacks to having a Medigap plan in addition to Medicare Part A and Part B coverage?

Although Medigap plans are an excellent way to help seniors manage their healthcare costs, it’s important to remember that they don’t come without some downsides. The primary drawback of Medigap coverage is the cost; depending on the type of Medigap plan purchased, monthly premiums can be expensive. Also, Medigap plans do not cover prescription drugs, which can often lead to additional out-of-pocket expenses for individuals taking multiple medications daily.

Another drawback of Medigap plans is that the provider network may be limited, meaning individuals have fewer options for choosing a doctor. Lastly, some private insurance policies do not cover services outside of their network; this is important to remember if you plan on traveling to another state or country and will require medical assistance while away from home.

How can you decide if a Medigap plan is right for you?

The best way to decide if Medigap is right for you is to attend Medigap seminars or speak with a Medigap representative. Medigap seminars provide an overview of different Medigap plans and can help individuals understand each plan’s various benefits and drawbacks.

In addition to Medigap seminars, it’s essential to speak with your doctor or healthcare provider about any health concerns or issues that you may have so that they can better inform your decision on whether Medigap coverage is necessary. It can help ensure you’re getting the most out of Medicare Parts A and B, along with the additional Medigap coverage.

What should you do if you have questions about your Medigap plan or Medicare coverage in general?

If you have any questions about your Medigap plan or Medicare coverage, it’s important to contact either Medicare or the insurance provider that provides it. You can also contact a local independent insurance agent specializing in Medicare-related issues if you are still looking for answers from those two sources.

It’s always essential to understand the details of any healthcare plans you’re considering, and asking questions is a great way to ensure you’re getting the most out of your coverage while avoiding any potential pitfalls associated with purchasing a new plan. Ultimately, taking the time to research and ask questions can help prevent unexpected costs down the line and make sure that your coverage is the best fit for your individual needs.

Where can you find more information about Medigap plans and Medicare coverage in general?

The Centers for Medicare & Medicaid Services (CMS) provides a wealth of information about Medigap plans and Medicare coverage in general. It includes information on different types of Medigap plans, eligibility requirements, and how to compare different types of plans.

Private insurance companies also provide helpful resources online; for instance, many will list the benefits and costs associated with their Medigap plans, which can be very useful when comparing different options. To learn more about the specifics associated with individual companies, it’s best to contact them directly or speak with an independent insurance agent knowledgeable about Medicare-related issues.

Additionally, numerous websites offer unbiased reviews and comparisons between different insurers so that you can make an informed decision about your coverage.